Medical tourism: Opportunities for new and specialized travel insurance products

Sophie Surr

Lead Underwriter

With medical inflation at an all-time high, the demand for overseas medical treatment is growing significantly. Currently estimated to be between $13 and 29 billion, the global medical tourism market is expected to reach $137 billion by 2032.1

Driving this growth, alongside increasing healthcare costs, are long waiting times for home-country care, advancements in healthcare technology, and increasing demand for specialized and elective treatments, such as dental reconstruction, cosmetic surgery, reproductive therapy and gender reassignment surgery2. Despite the perceived advantages of receiving treatments more quickly and cost effectively, traveling abroad for medical procedures is not without risk. As more people go overseas for treatments, public awareness of the potential for things to go wrong is also increasing. This, in turn, is increasing both the need and demand for specialty insurance products that provide a financial safety net for those opting for private medical care abroad.

Dissecting the Demand

Medical tourism is global and diverse and, each year, millions of US residents travel to countries across Latin America, Asia and Europe for medical care. Procedures include cancer treatment, dental care, fertility treatments, organ and tissue transplants and surgeries including bariatric, cosmetic and orthopedic.3

In Europe, the UK’s Office for National Statistics (ONS) estimated that in 2022, 348,000 UK residents travelled abroad for medical treatments such as dental and cosmetic surgery, cancer treatment, weight loss surgery, fertility treatment, organ transplants and stem cell therapy. This is because treatments are either unavailable on the National Health Service (NHS), the waiting times are too long, or private treatment may be found to cost less abroad. They also reported that transgender people may seek hormone therapy and gender reassignment surgery abroad.4

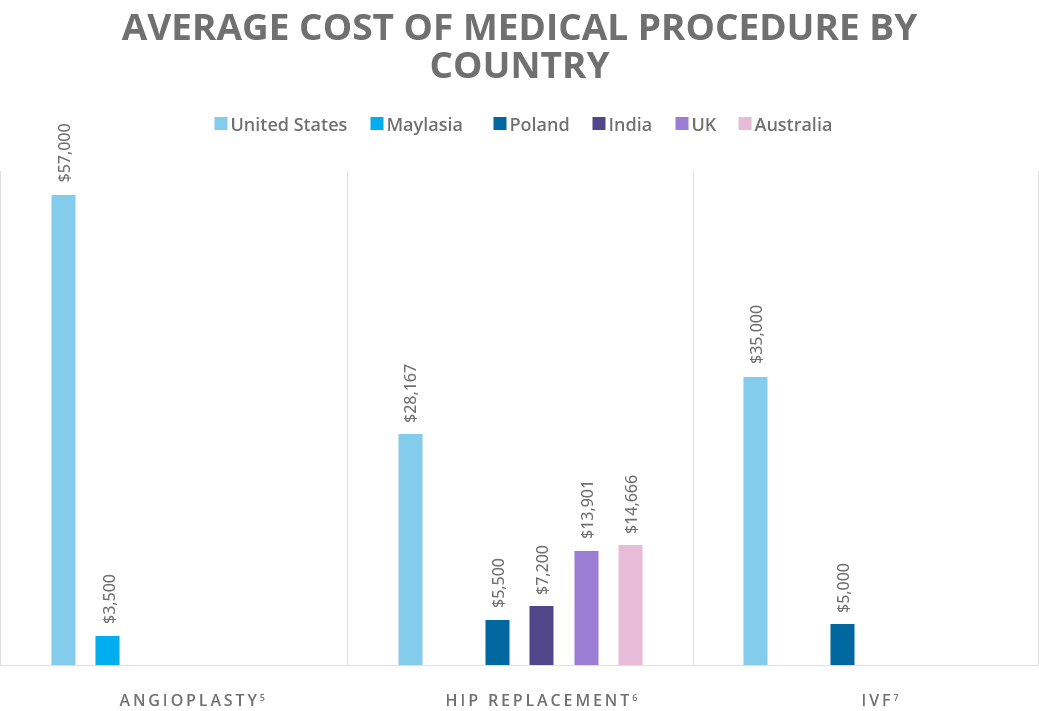

Much of this demand is driven by cost. The average cost of an angioplasty operation in the US, for example, ranges between $55,000 and $57,000 while the same procedure in Malaysia costs between $2,500 to $3,500.5

To better illustrate these costs differences, here is a comparison of various medical procedures across different countries:

To have a hip replacement in the US is estimated to cost $28,167, $14,666 in Australia and $13,901 in the UK. In India, the same procedure costs $7,200, and in Poland it costs $5,500.6 IVF in the US costs between $25,000 and $35,000, while in Spain, Poland, Thailand or Turkey that cost is on average between $2,500 and $5,000.7

Certain countries have established strong reputations for specific types of medical care. For example, Mexico, Hungary, and Thailand are known for their high quality and affordable dental facilities and Thailand is a top destination for cosmetic and bariatric surgery. Additionally, India is well known for offering more affordable hip replacements, gastric bypass operations and knee replacements.8

For UK citizens, Turkey is a popular country to travel to for cosmetic surgery or dental treatments, and the most common destinations for fertility treatment include Cyprus, the Czech Republic, and Greece.

While the primary catalysts for medical tourism are costs and waiting times, another reason why an individual may choose to travel abroad is for an experimental treatment. This could be because this treatment is not available in their home country, another country has a better reputation in this area, or because the experimental nature of the treatment may exclude it from traditional medical insurance, making it too expensive even if an individual is otherwise adequately insured.

Multiple Sclerosis patients from the UK9, US10 and Australia11, for example, are known to travel to Mexico for HSCT (hematopoietic stem cell transplantation). If a UK patient doesn’t qualify to have HSCT on the NHS, it would cost over $110,000 to receive the treatment privately.12

Need for Customized Comprehensive Coverage

While standard travel insurance may cover some overseas medical treatment, elective procedures, particularly dental, cosmetic and fertility, are often excluded. Specialty insurance providers, with expertise in niche travel and medical insurance needs, can fill this gap with flexible products designed exclusively around those traveling for this purpose.

In addition to standard coverage such as trip cancelation or postponement, personal accident and other non-medical complications, specialty insurers also have the flexibility to provide coverage for several other unforeseen eventualities. This could include medical complications arising after an elective procedure that require repeat travel or a longer than planned stay. They can also provide round the clock, global assistance in an emergency.

For example, if an individual had traveled abroad for cosmetic treatment but needed to return for corrective treatment, coverage can be provided for return flights, accommodations and a daily allowance. Additionally, if the individual needed to stay abroad for longer due to recovery, an accident or illness unrelated to the procedure, extended trip coverage could alleviate the extra costs this incurs.

Local Insurance, Global Reach

Many countries marketing themselves for their more affordable medical care may also offer insurance alongside the treatment. However, when traveling abroad for any medical treatment, having comprehensive and customized travel insurance is essential, as is purchasing insurance issued from a reputable insurer with global reach and expertise. Taking out insurance in an individual’s home country can also provide the added assurance of being governed by trusted financial regulators.

Not only is this more convenient, but, in the case of countries such as the US, UK, those within the European Union, and Australia, they are governed by trusted regulators providing extra assurance.

As medical costs continue to rise, our population ages and changes, and a growing number of international medical facilities take advantage of increasing demand for medical tourism, significantly more people are expected to travel overseas for both necessary and elective medical treatments. To ensure the insurance needs of these individuals are met, specialty insurers need to be nimble, entrepreneurial, and innovative. They must develop comprehensive coverage plans that address the unique risks associated with medical tourism, such as complications from procedures, travel disruptions, and post-treatment care. By leveraging technology, specialty insurers can offer real-time support and streamline claims processes, ensuring a seamless experience for their clients. Adapting to meet the growing demand and anticipating the variable development of the global medical tourism market will be crucial for these insurers to remain competitive and provide reliable, high-quality service to their policyholders.

- 1 https://www.fortunebusinessinsights.com/industry-reports/medical-tourism-market-100681

- 2 https://www.polarismarketresearch.com/industry-analysis/medical-tourism-market

- 3 https://wwwnc.cdc.gov/travel/yellowbook/2024/health-care-abroad/medical-tourism

- 4 https://travelhealthpro.org.uk/factsheet/59/medical-tourism-travelling-for-treatment#

- 5 https://www.polarismarketresearch.com/industry-analysis/medical-tourism-market

- 6 https://worldpopulationreview.com/country-rankings/hip-replacement-cost-by-country

- 7 https://us-uk.bookimed.com/article/medical-tourism-trends-among-americans-in-2018-top-destinations/

- 8 https://www.polarismarketresearch.com/industry-analysis/medical-tourism-market

- 9 https://www.mssociety.org.uk/support-and-community/community-blog/my-journey-hsct-scotland-mexico

- 10 https://onlinelibrary.wiley.com/doi/full/10.1002/cdt3.44

- 11 https://www.abc.net.au/news/2021-07-07/multiple-sclerosis-mexico-transplant-mission/100236822

- 12 https://www.aimscharity.org/what-is-hsct#:~:text=HSCT%20is%20available%20privately%20in%20the%20UK%20from%20around%20£90%2C000

This material is for general information, education, and discussion purposes only. Statements contained herein are not professional or legal advice of AXIS or its affiliates. AXIS makes no representations as to the accuracy or completeness of the information contained herein and is under no obligation to update or revise the information as a result of new information, research or future events. AXIS assumes no liability by reason of the information within this material.