Why AXIS

We are construction specialists

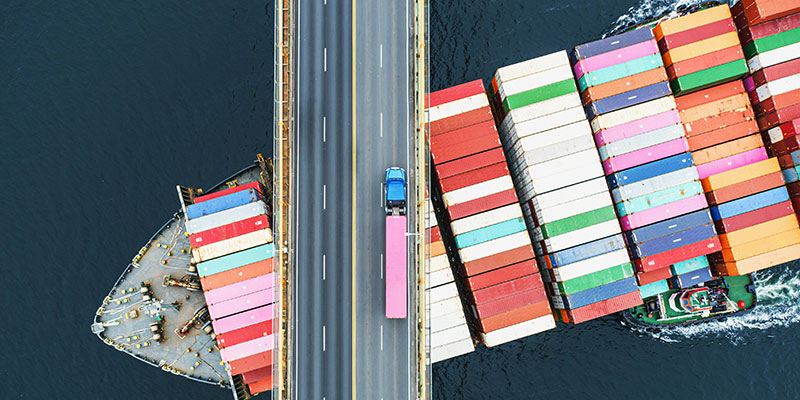

AXIS is among the market's most experienced insurers of worldwide construction risks, with a focus on infrastructure and power generation projects. We're one of a select set of global insurers capable of underwriting the largest projects.

The AXIS US Construction Insurance team has the experience and hands-on expertise to help brokers coordinate and assemble the capacity for these projects. Whether the risk is insured solely by AXIS or within a panel, we manage claims efficiently and effectively, advocating for customers and communicating clearly.

Emphasis on builder’s risk for commercial construction, infrastructure, and power

Appetite for a broad range of risks throughout the US and globally

Flexible program structures with 100% placed programs, lead quota share, follow form quota share, and selective appetite for excess

Solutions

Project Builder’s Risk

Designed for a single project with total insured values greater than $50,000,000

Master Builder’s Risk

- Tailored to cover most or all of a customer’s construction portfolio with dedicated limits, rates, terms, and conditions for various project types

- The MBR offers flexible reporting options for projects ranging from reporting forms to specific project attaching coverage

Additional coverages available

- Delay in Completion – coverage for Gross Income, Rental Income, Contractor Soft Costs, and Owner Soft Costs

- Coverage for Faulty, Defective, or Deficient Covered Property

- Contractors Equipment (including cranes, tunnel boring machines, and other specialized equipment critical to the project)

- Existing Real Property – extends coverage beyond just damage caused by construction operations

- Phased Construction – the ability to phase portions of a project on and off as they start or complete

Project Builder’s Risk

Designed for a single project with total insured values greater than $50,000,000

Master Builder’s Risk

- Tailored to cover most or all of a customer’s construction portfolio with dedicated limits, rates, terms, and conditions for various project types

- The MBR offers flexible reporting options for projects ranging from reporting forms to specific project attaching coverage

Additional coverages available

- Delay in Completion – coverage for Gross Income, Rental Income, Contractor Soft Costs, and Owner Soft Costs

- Coverage for Faulty, Defective, or Deficient Covered Property

- Contractors Equipment (including cranes, tunnel boring machines, and other specialized equipment critical to the project)

- Existing Real Property – extends coverage beyond just damage caused by construction operations

- Phased Construction – the ability to phase portions of a project on and off as they start or complete

Appetite

Target classes1

- Building construction

- Civil - bridges

- Civil - pipelines

- Civil - roads and rail

- Oil and gas – renewable

- Power generation 3

- Renewable, battery storage4

Acceptable classes2

- Civil - dams

- Civil - tunnels

- Civil - wet works

- Industrial

- Manufacturing

- Oil and gas – conventional

1Target classes - well within appetite and desired risk

2Acceptable classes - acceptable risk but may require aditional underwriting evaluation or involve limited capacity

3Nuclear - related power generation is "Acceptable" vs "Target"

4Some projects considered with AXIS Renewable Energy team

Capacity

- Up to $250,000,000 in capacity based on underwriting PML assessment

- Subject to higher hazard Nat Cat exposure and subsequent limit request, which may reduce our overall percentage offering

- Capability to provide Natural Catastrophe limits for projects in moderate to high hazard zones as well as non-critical zones

- Coverage on an admitted and non-admitted basis where available and when appropriate

Questionnaires and documents

Questionnaires and documents

CLT and Mass Timber Supplement

Questionnaires and documents

PBR Civil Infrastructure Supplement

Contact US

Construction solutions at your fingertips

To learn more about how the AXIS Construction team can help you, contact:

Claims

We deliver on our promises

Effective resolution for customers is achieved with our highly skilled claims specialists focusing on:

- Quick decision making

- Championing your needs

- An honest approach

∗Claims examples may be based on actual cases, composites of actual cases or hypothetical claim scenarios and are provided for illustrative purposes only. Facts have been changed to protect the confidentiality of the parties. Whether or to what extent a particular loss is covered depends on the facts and circumstances of the loss, the terms and conditions of the policy as issued and applicable law.

Related

What’s happening at AXIS

Related news and updates across the organization

Find your future at AXIS

We are a global insurer and reinsurer tackling unique challenges. At the heart of it all? Our people. As unique as the risks we face.